Cost of Daily Servings of Fresh Produce

June 1, 2018 | 8 min to read

IRI's analysis found that the average retail price for nine servings of fresh fruits and vegetables per day in the U.S. is $6.69, with whole watermelon and whole potatoes being the most affordable options across regions and seasons. Prices varied by season, peaking at $7.62 in fall/winter. While the Northeast had the highest costs, the Great Lakes recorded the lowest. The study highlights the significant price variance and suggests deeper affordability assessments may be necessary.

Originally printed in the June 2018 issue of Produce Business.

By Phillip E. Cottrell

Read Jim Prevor’s Commentary below

IRI completed an analysis to determine the lowest retail price for a consumer to purchase nine servings of fresh fruit and vegetables per day while having variety in his/her diet. The research focused on these key questions:

- What is the lowest average retail price for a consumer to purchase nine servings of fresh fruits and vegetables per day while having variety in his/her diet?

- What is the lowest average retail price for nine servings by season?

- What is the lowest average retail price for nine servings by region?

Parameters included:

- Spring/summer is an aggregate of Q2 and Q3 2015

- Fall/winter is an aggregate of Q4 2015 and Q1 2016

- One basket was represented by nine servings of fruits and vegetables, which includes four servings of fruit and five servings of vegetables

- Serving size is defined as a half cup of the edible portion of a product

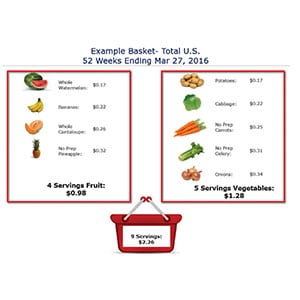

Total U.S. data showed $6.69 was the average retail price per basket of fruit and vegetables. The fruit and vegetables purchases over the past 52 weeks, ending March 27, 2016, had an average price per serving of $0.71 for fruit and $0.77 for vegetables in the total U.S. More than 20 varieties of fruit were priced lower than the average $0.71 price per serving.

Similarly, 18 varieties of vegetables were priced lower than the average $0.77 per serving, including potatoes, cabbage, carrots, celery, etc. Whole watermelon had the lowest cost per serving of fruit, and whole potatoes had the lowest cost per serving of vegetables over the course of 52 weeks. When examining each IRI-defined region over the annual time period, whole watermelon had the lowest cost per fruit serving in each region, while vegetables varied, with whole potatoes consistently appearing as least expensive in most regions.

Retail prices for nine servings varied between seasons, ranging from $5.94 in the spring/summer to $7.62 in the fall/winter. Vegetables’ retail price comprised 58 percent of the aggregate of the nine servings and ranged from $0.67 to $0.82 per serving throughout the year. Vegetables’ average retail price per serving ranged from $0.76 to $0.82 per serving in both seasons. Potatoes, cabbage and carrots were the three least expensive vegetables in both seasons.

Depending on region, other vegetables mentioned included beans, kale, celery, onions and sweet potatoes. Fruits ranged from $0.64 to $0.76 per serving. Watermelons, bananas and cantaloupe appeared in the top three least expensive fruits per serving in both seasons. Depending on region, other fruits mentioned included pineapple and other melons. The Great Lakes showed the lowest average price for nine servings for the year, with $5.91, followed by South Central, California, Mid South, West, Southeast, and Plains. The Northeast was the highest with $7.10.

In summary, the most economical fruits and vegetables consistently appeared across both geographies and seasons. Cost of these important dietary components is significantly higher (28 percent) in fall/winter vs. spring/summer. Regional impacts are less with the Northeast 6 percent higher than average and Great Lakes 12 percent lower.

Source: IRI FreshLook POS, Total US MULO, Latest 52 Weeks Ending 3-27-2016. Research funded by the National Watermelon Promotion Board.

RI is a leading provider of big data, predictive analytics and forward-looking insights that help CPG, OTC health care organizations, retailers, financial services and media companies grow their businesses. A confluence of major external events – a change in consumer buying habits, big data coming into its own, advanced analytics and personalized consumer activation – is leading to a seismic shift in drivers of success in all industries. With the largest repository of purchase, media, social, causal and loyalty data, all integrated on an on-demand, cloud-based technology platform, IRI is empowering the personalization revolution, helping to guide its more than 5,000 clients around the world in their quests to remain relentlessly relevant, capture market share, connect with consumers, collaborate with key constituents and deliver market-leading growth. For more information, visit www.iriworldwide.com.

Phillip E. Cottrell, a principal within IRI’s Strategic Analytics group since 2014, has provided analytics and insights to the CPG industry for nearly 30 years.

Five Other Cost Variables To Consider

By James Prevor

Many people claim consumption of fruits and vegetables is suppressed because of the supposedly prohibitive cost of fresh produce. Phillip E. Cotrell’s piece uses IRI data to clearly show that the cost of produce is, in objective terms, quite small.

Still that doesn’t quite give us enough to answer the full question of whether produce is truly affordable. There are at least five key variables that require more study:

1. Relative Cost

People have to eat. They need certain amounts of calories, certain nutrients, fats, fiber, etc. So, the question is usually not how much produce costs but where its cost compares to alternatives.

In foodservice, for example, the produce industry has long pushed restaurants to sell more produce by pointing out that produce is generally less expensive than proteins. It is a good argument – except restaurateurs are quick to point out that produce is more expensive than starches.

So, we would have to study the population and its current dietary expenditures to see if it is switching from steak or spaghetti to produce.

2. Budget Effect

Much of the literature points out, correctly, that any way you put it, a dramatic increase in produce consumption will require people to spend a great deal more on fruits and vegetables.

However, the public health goal is not to get people to increase the number of calories consumed. In fact, the goal is to decrease the amount of calories most people consume, as more calories consumed than expended is almost the definition of what causes weight gain and obesity.

So, if consumers boost produce consumption and thus purchases, and this means budgeting more for produce purchases, the question comes down to this: What would consumers eliminate from their purchases to buy more produce? Only by studying this can we see the budgetary effect of increasing fruit and vegetable consumption on households.

If 30 percent of produce does not get consumed because it goes bad, because people have other options, because the flavor isn’t great … well then, the cost of produce may be higher than we expect.

3. Food Need

What is also in need of study is the whole issue of satiety. It is not obvious how it works when people switch out 1,000 calories of beer for 1,000 calories of produce. For that matter, the satiety may be different between 1,000 calories of avocado, with its high oil content and creamy texture, and 1,000 calories of grapes or oranges with high sugar content, or 1,000 calories of lettuce. Then there is immediate satiety vs. whether one is hungry in an hour. This all plays into how much produce and what types people will be satisfied with and thus what they actually will buy. In this sense, this study is sort of abstract, assuming people will buy based on cost rather than taste, satiety, etc.

4. Real Product Cost

There is something rather quaint about this study. It is almost as if we are transported back to the 50s, and Donna Reed, never having a job outside the home, expects to spend hours preparing meals for her family.

One reason my personal produce consumption continues to grow is because I buy so many convenience items. I have pre-chopped onions to throw in my omelet, or there would be no onions in my omelet in the morning. The family loves watermelon, but we buy a lot of fresh-cut watermelon. A head of cabbage? We love stuffed cabbage, but that is a prepared-food purchase for us. We have coleslaw at every barbeque, but, again, we don’t make it.

It is nice to “prove” that consumers can eat for a reasonable cost if they want, but, maybe it would be more valuable to measure the actual fresh fruits and vegetables that people buy – in whatever form it comes.

Otherwise it is like proving cars are affordable by pointing out how much they cost without power steering, power breaks and with manual transmissions. Less than three percent of new cars sold in America have manual transmissions.

In reality, all of the fresh-cut and prepared fresh produce items exist because the cost of an item includes the time required to prepare it. So, the portrait of the industry portrayed in this study is not the produce industry as it actually exists today.

5. Shrink Cost

One thing the study does not address is whether consumers actually get the full benefit of fresh produce prices as low as these. If a consumer buys fresh fruit to make a morning breakfast smoothie but then gets called away on business or to take care of a sick parent or just is in the mood for something else, that produce may go rotten. If the consumer buys the exact same fruit in a frozen or canned form rather than fresh, nothing is lost.

If a consumer buys a box of mac-n-cheese, the product lasts virtually forever. Then there is this: Produce does not have consistent flavor. One can buy Kraft Macaroni & Cheese or Campbell’s Tomato Soup and know with virtually 100 percent certainty that if you like those products, you will get the enjoyment you expect. But produce is variable by time of year, variety, growing condition and lots more. Many times, children who love blueberries spit them out as too bitter.

What would be interesting to study is what, in fact, is the actual consumer experience of shrink. Food waste on packaged items can approach zero, but if 30 percent of produce does not get consumed because it goes bad, because people have other options, because the flavor isn’t great … well then, the cost of produce may be higher than we expect.

Like most research, the IRI sample tells us something useful, but it is just the beginning of a journey of learning before we can translate this knowledge into genuine insight.