Functionality and Health Trends Boost Outlook for Fresh Beverage Industry

June 14, 2024 | 9 min to read

Retailers are increasingly showcasing juice displays near produce aisles to leverage cross-merchandising opportunities and enhance sales. Advocates like Walter Nimocks and Stacey Anker emphasize the advantages of situating juice products for impulse purchases and trial encouragement. Consumer trends point toward health-focused, lower-sugar options, leading to innovations like A de Coco's convenient coconut products. As retailers adjust to emerging brands, there is a strong sense of optimism for growth and market adaptation in 2024.

PRODUCE BUSINESS/SUSAN CROWELL PHOTO

Retailers are responding positively to unique products and emerging brands.

ONLINE EXCLUSIVE

In the minds of many consumers, juice — the freshly pressed, rather than UHT variety — is intrinsically linked to produce, so it is no wonder processors are establishing a more upfront connection between the two categories. To capitalize on the link, juice companies recommend grocery retailers situate juice displays close to the produce aisles, and there is evidence that those who do can reap substantial benefits.

Walter Nimocks, founder of Houston, TX-based Just Made Foods, which markets a range of tropical fruit-focused mixes and shots, advocates placing juice products close to produce to take advantage of cross-merchandising opportunities.

“Putting juice next to fruit is usually a good call, so I would recommend retailers focus on the produce area of the store,” he says. “Having complementary items merchandised together is really valuable, really important.”

Nimocks recommends also situating fruit shots nearby, suggesting keeping them in their display trays can be a real win for retailers as they don’t require stacking. “Shots are really valuable for the retailer because they can merchandise a lot of shots together on the shelf and they can be extremely productive for them,” he continues.

Nimocks also cites “grab and go” as a phenomenon that benefits retailers and fresh beverage suppliers alike. “Grab and go, for us, is a huge opportunity,” he says. “I recommend retailers keep juices close to the front of the store, so they are very visible and available for grab and go.

For Stacey Anker, director of marketing for Los Angeles, CA-based juice company POM Wonderful, making explicit the link between fresh pomegranates — the brand’s key ingredient — and their range of juices and arils makes strong commercial sense.

“For our whole pomegranates, we’ve found that displays are the No. 1 trigger for pomegranate trial,” she says, adding Wonderful also uses coupons and cross-promotion with the full family of POM products to help sell more juice and pomegranates

Will van Ingen from New Braunfels, TX-based Fresh & Direct, a company that markets Mexican coconut and coconut water brand A de Coco in the U.S., agrees the health and wellness trend offers a clear opportunity for effective cross-merchandising

“Creating thematic displays, especially in health and wellness sections, can draw attention to the unique qualities of coconut water,” he says. “Additionally, offering tastings or samples can encourage trial and drive impulse purchases. Integrating digital elements like QR codes for additional product information or recipes can also enhance customer engagement.”

PRODUCT INNOVATIONS

According to van Ingen, A de Coco U.S. has a range of fresh coconut products, offering 100% natural products with no added ingredients. For 2024, the company is introducing “Poke-n-Drink Young Fresh Coconuts,” a new product that has been developed to cater to a “growing market segment that values the authenticity and health benefits of fresh coconut water, but also seeks ease of use.”

The inclusion of a skewer, straw, and napkin in the packaging simplifies the process of accessing the coconut water, and also addresses the demand for on-the-go consumption options, van Ingen continues.

This approach, he says, is particularly appealing in today’s fast-paced lifestyle where convenience is a key deciding factor for many consumers. “Unlike what’s out there on the market, this will allow consumers to quickly open a coconut, insert a straw, and begin enjoying the fresh water.”

Anker says POM Wonderful is constantly exploring new products and flavor combinations, explaining that a top priority of the business is educating potential and existing consumers on its products’ health benefits.

In 2023, the company launched a national campaign, Real Life Is Scary: Protect Yourself With POM, which Anker says was aimed at empowering consumers to “fortify their defenses against free radicals.”

PRODUCE BUSINESS/SUSAN CROWELL PHOTO

“These are unstable molecules that can cause damage to our bodies over time,” she says. “Consumers can protect themselves with the antioxidant power of POM Wonderful 100% Pomegranate Juice.”

Anker says POM is working with retailers to ensure products are being highlighted to encourage sales, and reveals the company is continuing to expand its retail presence across the country. This includes the reintroduction of POM Wonderful 100% Pomegranate Juice to Costco stores nationwide.

Just Made’s Nimocks, who established the company in 2016 with wife Norka following a long career in the food industry, has enjoyed considerable success with a range of juice products, many of which are inspired by traditional, Latin American recipes.

The company’s range of premium cold-pressed juices includes top sellers such as “Heart Health” Beets & Turmeric, “Vitality” Prickly Pear & Watermelon, and “Immunity” Blood Orange & Acerola. More recent additions include “Passion Dragon,” a mix of passion fruit, pineapple and maca root based on a traditional Nicaraguan beverage, and a “Wellness” pineapple and ginger mix inspired by what Nimocks describes as “the national drink of Jamaica.” Just Made’s version swaps pear juice for the copious amounts of sugar contained in the original version. Another recent addition is “Turmeric Defense,” a combination of passion fruit, turmeric, pineapple and carrot.

The company is also launching six new shots, based on its existing juice blends, with a focus on wellness. According to Nimocks, Just Made’s shots are different from existing shots by staying true its brand and unique flavors. The range includes: “Recovery + Immunity” with turmeric and oregano; “Productivity + Energy” comprising Lion’s Mane mushrooms and guaraná; “Gut Health +Probiotics” with papaya and ginger; “Heart Health” featuring beets and ginger; “Immunity + Antioxidants” with blueberry, lemon and honey; and “Mood + Anti-Stress” made with medicinal ashwagandha herb.

ON-TREND INGREDIENTS

So, what are the trends currently influencing the development of the juice category? According to POM’s Anker, the most significant trend at the current time is a generalized consumer shift toward healthier eating habits and a gravitation toward better-for-you products.

At the same time, she says consumers are seeking easy-to-access information about products, citing the example of POM’s in-store display QR codes, which direct consumers to details of health benefits, research, recipes, and tips.

Just Made’s Nimocks believes there is also growth potential in functional juices, which he describes as still on trend for consumers. “They are walking away from straight juice and are instead looking for functionality; that’s where we see the growth,” he says.

Another important trend, Nimocks continues, is an increasing consumer desire to reduce the amount of sugar in their diets. “Three out of four consumers are taking less sugar in their diets and that’s where shots come in,” he says. “You get the same benefits as juice, but with a lot less sugar.”

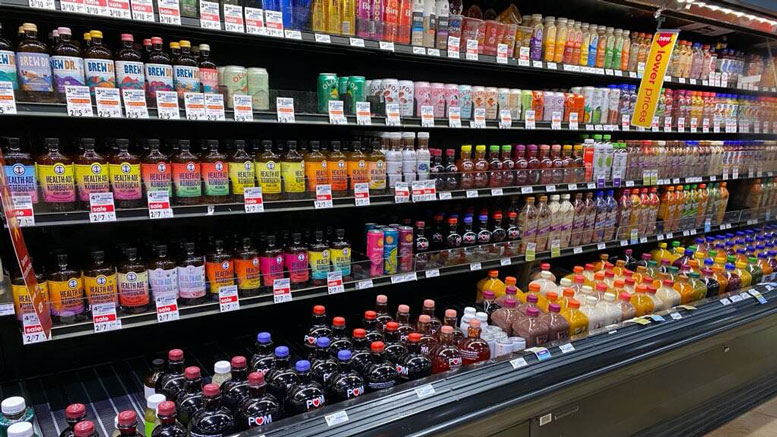

Retailers are devoting more space to fresh beverages that cater to the rising consumer demand for healthier drink options.

At the same time, Nimocks believes consumers, and especially younger shoppers, are becoming more experimental when it comes to trying different fruits and ingredients, citing the example of Just Made’s use of unusual ingredients such as lion’s mane mushrooms and maca root.

“Mood and anxiety is really important to younger consumers (18-34) who are saying they feel more stressed and anxious,” he explains. “Older consumers are more focused on heart and gut health.”

Fresh & Direct’s van Ingen agrees with that assessment. “There is an increased focus on health and wellness, with a growing interest in natural, functional beverages that offer more than just basic nutrition,” he says. “Coconut water, for example, has been gaining popularity due to its health benefits and refreshing taste.”

Retailers, van Ingen continues, are also devoting more space to fresh beverages that cater to the rising consumer demand for healthier drink options.

He says the juice shot trend aligns with this increasing consumer emphasis on health and wellness, driving demand for juices packed with more beneficial ingredients.

The trend toward low-sugar or sugar-free options in juices reflects the growing health consciousness among consumers, van Ingen continues. One influencing factor is a preference of some athletes for coconut water rather than manufactured sports drinks, which may contain higher calories, sugars and fewer electrolytes.

“Merchandising and presentation trends for coconut water in the beverage industry are centered around, once again, health and wellness, eco-friendliness and immersive customer experiences,” van Ingen adds. “The marketing of coconut water is likely to focus on its health benefits, such as hydration and nutritional content, catering to the growing consumer interest in health-centric products.”

PACKAGING DRIVERS

When it comes to packaging, Nimocks says Just Made focuses on colors and designs that really “stand out on the shelf,” rather than going for the clear-bottle approach.

“You can pick up the bottle and see the liquid in the back, but vibrant colors are really important because you have to capture consumers’ imagination,” he argues.

Nimocks predicts sustainability in beverage packaging will be the “next shoe to drop” for the industry. The adoption of rPET in particular, he believes, has potential for beverage producers, although there is concern raw material prices could rise as demand grows among major drinks companies.

There are signs that movement is already happening. Fresh & Direct’s van Ingen says there is a trend toward more sustainable and eco-friendly packaging across merchandising and presentation, with companies looking for innovative ways to reduce their environmental impact.

“Sustainability is a key aspect, with an emphasis on eco-friendly packaging and responsible sourcing appealing to environmentally conscious consumers,” he says.

Van Ingen says the “Poke-n-Drink Young Fresh Coconut” is a great example of what A de Coco is doing when it comes to packaging innovations. “We’re not using as much plastic and are allowing consumers to enjoy true 100% natural coconut water in their very own source, the coconut,” he says. “By reducing plastic usage and enabling consumers to enjoy coconut water directly from its natural source, this product aligns with the growing global emphasis on sustainability and health.”

“It offers a unique, tropical experience that differentiates it from other beverages in the market,” he claims. “This can be particularly appealing in marketing campaigns, emphasizing the natural and unprocessed quality of the product.

As part of POM Wonderful’s sustainability commitment to reduce single-use plastic and transition to 100% recycled plastic (rPET) bottles, Anker says all the company’s 16-ounce bottles of POM Wonderful Juice in North America — 100% Pomegranate Juice, Pomegranate Blueberry 100% Juice, and Pomegranate Cherry 100% Juice — are now bottled in 100% rPET and feature a “100% Recycled Plastic” logo.

CAUSE FOR OPTIMISM

For Fresh & Direct, the pricing and supply of many of the ingredients that go into fresh juices and juice mixes are influenced by dynamic factors such as agricultural conditions, global supply chain issues, consumer demand, and broader economic trends. And of course, he says, inflation has a lot to do with product pricing.

Just Made’s Nimocks says his company has looked at its supply chain to see where it can cut costs. “Last quarter and before that, we were starting to see units decline at a rate of 2-3%,” he reveals. “That’s pretty big when you are accustomed to 3-4% unit growth.”

The decline, Nimocks believes, has to do with inflation and its impact on the consumer. “Even during the pandemic, we were looking to find efficiencies and we were able to hold our prices,” he says. “As a result, I think we are in a better situation than some of the big brands. Some are taking a big hit as a result, because juice that before cost $3.99, now costs $4.99.”

“We’re excited about 2024,” adds Nimocks. “There’s lots of opportunities for emerging brands and lots of opportunities for growth. Retailers are really responding to our unique products. Retailers that before maybe said, ‘not now,’ are now saying, ‘bring it on.’”

Just Made is also exploring more digital marketing, partnering with retailers on apps and digital coupons, “and we see huge potential there,” Nimocks says. “Our club business has also continued to grow. Overall, we’re very optimistic about 2024.”

9 of 16 article in Produce Business June 2024